Tracking When Film Distribution Will End

by Michael Karagosian

©2011 MKPE Consulting LLC All rights reserved worldwide

originally published in the 15 March 2011 issue of Digital Cinema Report

Exhibitors have every reason to be concerned about when it will be no longer economical to distribute film. There are several factors that will contribute to the decision, and it is likely that no one factor will dominate. This article takes a look at some of the decision points.

The US is installing digital screens at a fair clip today, largely driven by the pace of installations conducted by DCIP. Assuming no difficulty in obtaining the remaining financing needed, DCIP alone will add approximately 16,000 digital screens by 2013. There were 14,500 digital screens installed in the US at the beginning of 2011, of which approximately 5300 were DCIP-owned. If only DCIP were to continue to install, the US will have approximately 25,200 screens in 2013.

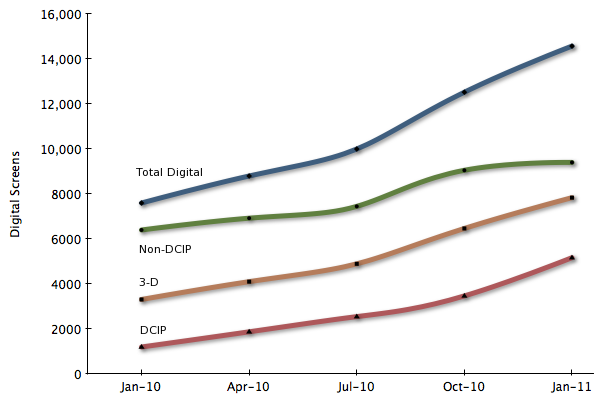

The rate of installation of non-DCIP screens is a little harder to determine. Juggling the numbers, approximately 1800 non-DCIP screens were converted in 2010, the majority of which, if not all, are financed by VPFs. Assuming that pace continues, we'll see another 3600 screens added by the end of 2012. The chart in Figure 1 shows the rate of installation in 2010 for the different categories of digital screens.

Growth of Digital Screens in 2010

While the pace of installations in the rest of the world has been led by 3-D, the pace of installations in the US is clearly led by VPF financing. As the rollout periods for US deployment entities expire, the installation rate in the US will dramatically reduce. Looking ahead, the rollout period for most the US deployment agreements end in 2012. Cinedigm's Phase II rollout period, for example, ends in October 2012, well before year-end. So the estimate of 3600 additional non-DCIP screens by the end of that period could be generous.

This analysis gives us a picture for how the rollout in the US is likely to proceed. As the deployment entity rollout periods end, and DCIP completes its rollout, the US will have around 28,800 digital screens in 2013. Assuming 39,000 screens total in the US, this means that about 74% will be digital. Following the expiration of VPF rollout periods, the growth rate of digital screens will dramatically reduce, and the incentive to convert the remaining screens will be driven by competition in the marketplace and the pending termination of film distribution.

74% conversion of screens might appear to some to be enough to trigger a cutoff of film. But let's examine that a little more closely.

Virtual print fees are generally determined by taking the cost of film distribution and subtracting the cost of digital distribution. A distributor that pays a VPF along with a digital booking encounters a combined cost that equals that of distributing film prints. In other words, when a VPF is paid, it costs no more to distribute film than digital. As long as a screen produces more revenue than the cost to distribute product to the screen, it doesn't make a lot of sense to cut off film early. There are factors that will influence this, of course, such as inevitable increases in the cost of film itself.

Longer term, once the obligation to pay VPFs goes away, the cost to distribute digitally significantly drops. With a large number of digital screens available, and a much greater delta between the cost to distribute digitally and the cost to distribute film, the incentive to cutoff film will increase. If 74% of conversion to digital is the low end of the tipping point, then the termination of VPF payments is the upper end. That would place the gray period for film cutoff in the US between 2013 and, say, 2020.

The throw of the dart is left as an exercise for the reader. (My dart lands close to the end of the scale, say 2018 or later.)

Film cutoff in the rest-of-world does not need to follow that of the US. Low cost film duplicators in other regions change the economic rationale. As will a potentially slower technology conversion rate, now that the 3-D conversion boom is behind us. The challenge in the rest of the world is to convert 2-D film screens to digital. Many exhibitors bought 3-D projectors with the hope of getting a VPF subsidy to convert their remaining screens. But with the cost of film distribution so low in many regions, the VPFs available are also low, reducing the incentive to convert. The extent to which exhibitors are incentivized to convert will influence the cut off decision in their region.